Best Places to Invest in an Airbnb in Ohio

Discover the Top Short-Term Rental Markets in the Buckeye State

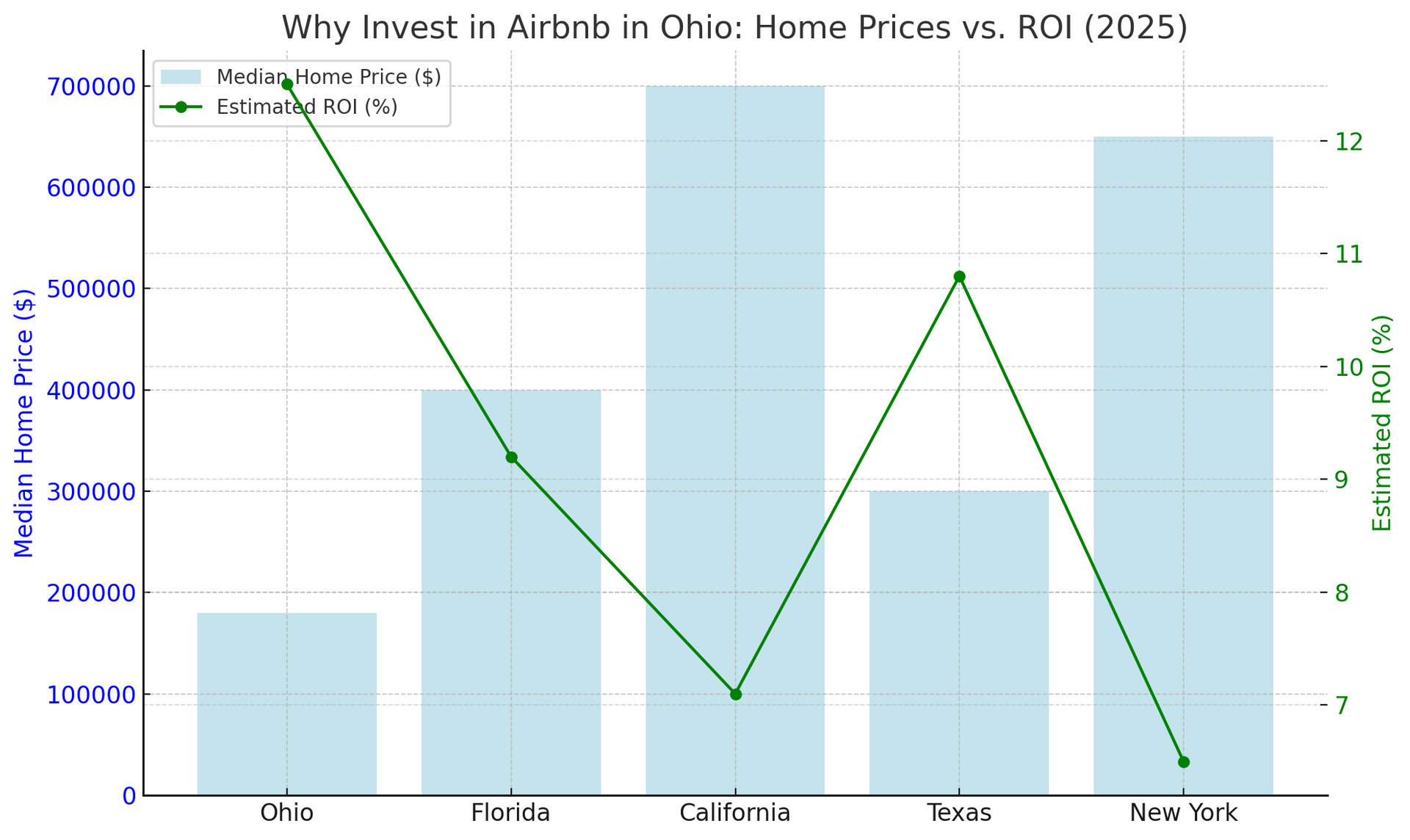

If you’re looking for one of the most profitable and underrated states to invest in short-term rentals in 2025, look no further than Ohio. With its mix of thriving urban centers, breathtaking natural attractions, and affordable housing markets, Ohio has emerged as a top Airbnb investment destination that’s catching the attention of both beginner and seasoned investors alike.

While traditional vacation rental hotspots like Florida and California are facing oversaturation and regulatory crackdowns, Ohio is quietly experiencing a short-term rental boom. Cities like Columbus, Cleveland, and Akron are seeing surges in tourism, event traffic, and business travel—while nature-focused destinations like Hocking Hills and Athens are becoming go-to spots for cabin lovers and weekend travelers.

But is 2025 too late to invest in Ohio’s Airbnb market?

Not even close. In fact, this year may be your best chance before home prices rise and the market becomes more competitive.

Why Invest in Airbnb Properties in Ohio in 2025?

Ohio may not be the first place that comes to mind for Airbnb investments—but it should be. Here's why:

1. Strong Short-Term Rental Market Growth

According to data from Statista, the U.S. short-term rental market is projected to reach $24.78 billion by 2029, and Ohio is contributing steadily to this growth. The state is experiencing a significant increase in year-round tourism, supported by events, concerts, universities, national parks, and family-friendly attractions.

Whether it’s the Rock & Roll Hall of Fame, Cedar Point Amusement Park, or the countless hiking trails of Hocking Hills, Ohio attracts both leisure and business travelers in every season.

2. Affordable Real Estate with High ROI Potential

Ohio consistently ranks among the top 10 most affordable states to buy a home. That’s huge for Airbnb investors. Cities like Akron and Springfield have median home prices under $150,000, which is a steal when paired with high occupancy rates and solid daily rental rates.

Imagine paying half the price of a Florida beach condo and still pulling in $25,000–$35,000 per year in rental income. That’s the power of Midwest investing.

3. Diverse Market Types: Urban, Suburban, and Rural

Ohio is unique in that it offers three distinct types of Airbnb opportunities:

- Urban centers like Columbus and Cleveland are great for short stays and business travelers.

- Suburban areas like Grove City and Gahanna are ideal for families or longer stays.

- Rural/vacation areas like Logan and Athens cater to nature lovers and retreat seekers.

This gives investors the flexibility to choose a market that matches their risk tolerance, budget, and preferred guest profile.

4. Favorable Airbnb Regulations (For Now)

Compared to states like New York or California, Ohio has relatively lenient short-term rental laws. While regulations vary by city, most markets only require basic permits and safety inspections. This makes it easier for investors to operate legally without navigating excessive red tape.

5. Low Barrier to Entry for New Investors

Because of its low real estate prices, simple regulations, and steady demand, Ohio is a smart entry point for new Airbnb investors. You don’t need $500K to get started—some top-performing markets have homes under $150K, making it possible to build a profitable Airbnb portfolio with minimal capital.

Bonus: Ohio’s Short-Term Rental Demand is Still Rising

With increased domestic travel, the rise of work-from-anywhere culture, and a growing preference for unique stays over hotels, Airbnb demand in Ohio is projected to increase steadily throughout 2025 and beyond.

“Buy low, rent high, and let the Midwest magic work for you.”

Top 10 Best Cities to Invest in an Airbnb in Ohio (2025 Edition)

Ohio has a unique blend of affordability, demand, and consistent rental returns. We’ve ranked the top 10 Airbnb markets in the state based on average daily rates (ADR), occupancy rates, median home prices, and estimated annual revenue—giving you a clear picture of which cities offer the best bang for your buck in 2025.

Let’s dive into the best places to buy an Airbnb in Ohio this year:

1. Columbus, OH

ADR: $125 | Occupancy Rate: 58% | Median Home Price: $270,000 | Est. Annual Revenue: $26,000

As Ohio’s capital and largest city, Columbus is the crown jewel of Airbnb investing in the state. With Ohio State University, Fortune 500 companies, and a booming arts and tech scene, demand is strong year-round from students, professionals, and tourists alike.

Why Columbus is a Great Airbnb Market:

- Reliable income stream with high urban rental demand

- Popular areas like Short North and German Village attract trendy travelers

- Home to major events: college football games, concerts, conventions

- Close to the John Glenn Columbus International Airport

Pro Tip:

Invest in smaller units or trendy lofts near the university or downtown for steady bookings.

2. Cleveland, OH

ADR: $101 | Occupancy Rate: 59% | Median Home Price: $132,000 | Est. Annual Revenue: $24,000

Cleveland is a cultural hub known for the Rock & Roll Hall of Fame and Lake Erie views. It’s ideal for budget-conscious investors seeking strong rental demand and low property costs.

Why Investors Love Cleveland:

- Low barrier to entry (one of the cheapest real estate markets in the U.S.)

- Consistent demand from medical, sports, and music-related tourism

- Prime neighborhoods include Ohio City, Tremont, and Downtown

Investment Tip:

Cleveland is perfect for investors wanting solid returns on low-cost properties. A $130K home here can produce revenue similar to a $300K home elsewhere.

3. Akron, OH

ADR: $112 | Occupancy Rate: 62% | Median Home Price: $132,000 | Est. Annual Revenue: $26,000

Akron offers high occupancy and low median home prices. Close to Cuyahoga Valley National Park, it's ideal for both nature-loving travelers and city visitors.

Highlights:

- Close proximity to Cuyahoga Valley National Park

- Excellent ADR-to-home-price ratio

- Hosts events year-round, including art shows, marathons, and car shows

Best Performing Properties: 2-bedroom homes near downtown or close to the university tend to perform best.

4. Logan (Hocking Hills), OH

ADR: $158 | Occupancy Rate: 53% | Median Home Price: $303,000 | Est. Annual Revenue: $30,000

Logan is the gateway to Hocking Hills State Park, Ohio’s top nature destination. It's perfect for luxury cabins and outdoor-themed rentals with strong seasonal demand.

Why Hocking Hills is Gold for STRs:

- Destination for hiking, glamping, and romantic getaways

- High demand for secluded, well-designed cabins

- Close to Hocking Hills State Park and Old Man’s Cave

What Works Best: Invest in unique stays like A-frame cabins, hot tub properties, or pet-friendly lodges.

5. Springfield, OH

ADR: $112 | Occupancy Rate: 62% | Median Home Price: $225,000 | Est. Annual Revenue: $26,000

Often overlooked, Springfield is seeing growth thanks to heritage tourism, historical architecture, and an influx of younger families and professionals.

Why Springfield is Worth Watching:

- Excellent occupancy rate with solid ADR

- Close proximity to Dayton and Columbus

- Strong appeal for history buffs and road trippers

Tip: Properties near downtown’s revitalized historic district are showing strong guest reviews and occupancy.

6. Vermilion, OH

ADR: $175 | Occupancy Rate: 58% | Median Home Price: $275,000 | Est. Annual Revenue: $35,000

Located on the shores of Lake Erie, Vermilion is a picturesque lake town ideal for summer vacationers and couples’ getaways.

Vermilion Investment Highlights:

- Highest earning potential on this list

- Seasonal demand peaks in summer, with lakefront bookings at a premium

- Charming downtown with wine bars, art shops, and boat rentals

Strategy: Focus on well-designed lakefront or lake-adjacent homes. Maximize earnings with seasonal pricing.

7. New Albany, OH

ADR: $156 | Occupancy Rate: 68% | Median Home Price: $380,000 | Est. Annual Revenue: $39,000

One of the wealthiest suburbs of Columbus, New Albany caters to business travelers, families, and medical tourists. Though property prices are higher, the occupancy rate is among the highest in Ohio.

Highlights:

- Great for luxury Airbnb investments

- Proximity to tech campuses and New Albany Business Park

- Safe, walkable community with top-rated schools

Note: Larger 3–4 bedroom homes or entire guesthouses tend to outperform single-room rentals.

8. Grove City, OH

ADR: $114 | Occupancy Rate: 75% | Median Home Price: $290,000 | Est. Annual Revenue: $28,000

With the highest occupancy rate on this list (75%), Grove City is a goldmine for consistent Airbnb bookings.

What Makes Grove City Stand Out:

- Strong demand from visiting families and business professionals

- Just minutes from downtown Columbus

- New housing developments and shopping hubs make it traveler-friendly

Tip: Invest in modern townhomes or family-sized homes near Stringtown Road.

9. Athens, OH

ADR: $174 | Occupancy Rate: 49% | Median Home Price: $310,000 | Est. Annual Revenue: $31,000

Home to Ohio University, Athens attracts both student-related guests and visitors to the beautiful Appalachian foothills.

Why It Works:

- Strong seasonal demand (university events, nature escapes)

- Good potential for hybrid rentals (Airbnb + mid-term)

- Popular with digital nomads and wellness travelers

Strategy: Target events like graduation weekends and festivals to push up your rates.

10. Gahanna, OH

ADR: $145 | Occupancy Rate: 65% | Median Home Price: $315,000 | Est. Annual Revenue: $33,000

Located just outside Columbus, Gahanna offers an ideal balance of urban accessibility and suburban peace.

Benefits of Investing in Gahanna:

- 10 mins to the Columbus Airport (great for business travelers)

- Consistently high guest satisfaction ratings

- Family-friendly with strong local amenities

Tip:Look for homes near Creekside Park or the downtown area for maximum visibility and bookings.

Looking beyond Ohio? Check outHome Team’s national guide on the best places to buy an Airbnb for more top-performing cities across the U.S.

Emerging Airbnb Markets in Ohio for 2025

Where to Invest Before Everyone Else Does

While the top 10 cities we covered offer proven returns, there are still untapped Airbnb markets in Ohio poised for growth. These areas are attracting new attention due to infrastructure investments, rising tourism, and economic revitalization—making them ideal for early-stage investors looking to catch the next wave.

Here are the most promising up-and-coming short-term rental markets in Ohio:

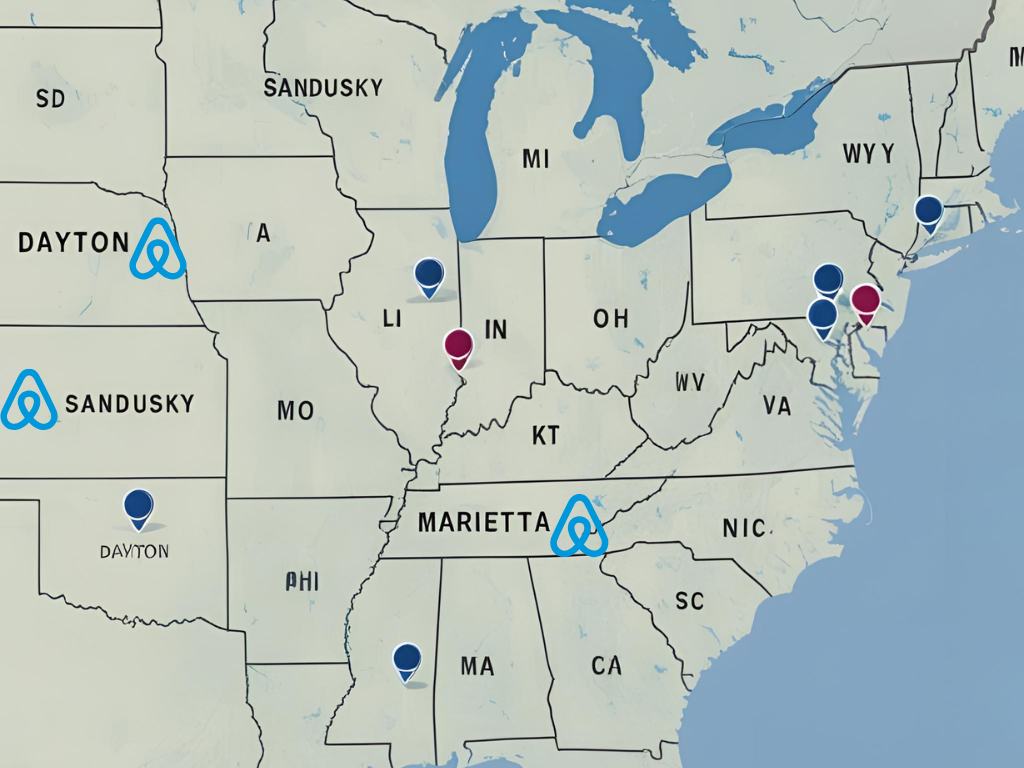

1. Dayton, OH

ADR: ~$110 | Occupancy Rate: 55% | Median Home Price: ~$165,000

Dayton is quietly climbing the Airbnb charts thanks to a growing population, affordable housing, and the presence of the National Museum of the U.S. Air Force—which draws over a million visitors per year. It's also home to Wright-Patterson Air Force Base and several universities, making it a diverse demand market.

Why Dayton Is On the Rise:

- Consistent visitor flow from military, students, and aviation tourists

- Revitalized downtown with breweries, lofts, and concert venues

- Entry-level property prices offer low investment risk

Pro Tip: Target 2-bedroom units close to the University of Dayton or in the Oregon Historic District.

2. Sandusky, OH

ADR: ~$145 | Occupancy Rate: 50–55% | Median Home Price: ~$185,000

Sandusky is a prime vacation rental market during the summer months. Why? It’s home to Cedar Point, one of the top-rated amusement parks in the world. While seasonal, Airbnb hosts in this city can earn a significant chunk of their annual income in just a few summer months.

What Makes Sandusky a Smart Bet:

- Massive seasonal demand (May to September)

- Ideal for themed stays (family-friendly, pet-friendly, lakeside escapes)

- Growth in lakefront property development

Hosting Strategy: Offer packages with park info, discount coupons, or lake tour guides. Cottages and lakefront homes perform best.

3. Toledo, OH

ADR: ~$105 | Occupancy Rate: 54% | Median Home Price: ~$140,000

Often overlooked, Toledo has some of the lowest home prices in the state but is starting to attract short-term renters thanks to its downtown redevelopment, access to Lake Erie, and attractions like the Toledo Zoo and Museum of Art.

Why Toledo is an Underrated Market:

- Very low buy-in cost for investors

- Potential for dual-use rentals (short-term + long-term or mid-term)

- Market is less saturated compared to bigger cities

Where to Look: Focus on Old West End, Downtown, and areas near the University of Toledo.

4. Marietta, OH

ADR: ~$135 | Occupancy Rate: 55–60% | Median Home Price: ~$200,000

Marietta is one of the most scenic small towns in Ohio and is gaining attention for its riverside charm, historic appeal, and access to the Ohio River. It’s a popular weekend destination for travelers looking for a relaxing getaway.

Why Consider Marietta:

- Picturesque, Instagrammable property potential

- Perfect for romantic or peaceful getaways

- Appeals to retirees, couples, and history lovers

Hosting Tip: Renovated historic homes or cozy modern cottages near the downtown area perform best.

5. Zanesville, OH

ADR: ~$120 | Occupancy Rate: 57% | Median Home Price: ~$150,000

Located just an hour from Columbus, Zanesville is one of those smaller towns with big potential. Its blend of arts culture, nature access, and affordability is putting it on the radar of travelers and remote workers.

Why Zanesville Could Be a Smart Play:

- Proximity to Columbus = overflow tourism potential

- Great for arts-and-culture-focused Airbnbs

- Affordable properties with space for unique designs

Creative Angle:

A themed Airbnb (artist loft, pottery-themed retreat, or boho studio) could set your listing apart.

Why Emerging Markets Are Worth Considering

These emerging markets may not have the numbers of Columbus or Cleveland yet, but they offer something even more powerful: upside potential. Getting in early often means:

- Lower property taxes and purchase costs

- Less competition among STR operators

- Higher future appreciation as demand builds

If you’re willing to be a first mover, these markets could provide excellent long-term gains, especially when paired with great guest experiences and smart pricing strategies.

Ohio Airbnb Regulations & Short-Term Rental Laws (2025 Update)

Know Before You Invest

While Ohio is considered relatively friendly to short-term rental (STR) operators, laws and regulations vary widely by city and county. Whether you're investing in a vacation cabin in Logan or a city loft in Cleveland, it's important to understand the local rules to avoid penalties, fines, or forced shutdowns of your Airbnb.

This guide will help you navigate the current regulatory landscape and stay compliant.

General Overview: Ohio State Laws on Short-Term Rentals

As of early 2025, there are no state-level laws banning Airbnb or short-term rentals in Ohio. That said, the state allows municipalities to set their own regulations, which can include licensing, zoning restrictions, or tax requirements.

Here are key areas to understand:

- Zoning laws – Some cities restrict STRs in certain residential zones.

- Licensing – A growing number of Ohio cities require hosts to register their rental properties.

- Safety inspections – Especially in cities like Cincinnati or Columbus.

- Tax registration – Hosts must typically collect and remit a lodging tax (similar to a hotel tax).

If you operate an Airbnb in Ohio, you’re responsible for collecting and remitting the appropriate taxes. These may include:

| Tax Type | Who Collects It | Rate |

|---|---|---|

| State Sales Tax | Airbnb (in most cases) | 5.75% |

| Local Lodging/Hotel Tax | Airbnb OR host (varies) | 3%–7% (varies) |

| Income Tax (on earnings) | Host | Varies by income |

Airbnb typically collects state taxes automatically, but hosts are often still responsible for local lodging taxes, depending on the city.

Compliance Tips for Investors

- Always contact the city zoning office before purchasing a property

- Register your STR as soon as possible—fees are usually $50–$250 annually

- Use Airbnb’s “Responsible Hosting” page as a starting point for legal info

- Consider hiring a local property manager or co-host to help with compliance

- Save for potential inspection or license renewal fees

What Happens if You Don’t Comply?

Operating an unregistered short-term rental in Ohio can result in:

- Fines ranging from $250 to $1,000 per violation

- Delisting from Airbnb or Vrbo

- Forced shutdowns or zoning lawsuits

So yes, compliance is non-negotiable—but thankfully, it's still manageable in most Ohio cities.

Final Note on STR Laws

Ohio remains an Airbnb-friendly state compared to more regulated markets like California or New York. As long as you stay informed and follow local guidelines, it’s relatively simple to operate a profitable, legal short-term rental in 2025.

What Keeps Guests Booking in Every Season

One of the biggest advantages of investing in Airbnb properties in Ohio is the state’s diverse and year-round tourism appeal. From music history to national parks, Ohio offers a range of attractions that draw in millions of visitors each year—creating constant demand for short-term rentals.

Here are five powerhouse attractions that are keeping Ohio’s Airbnb calendars full in 2025:

1. Rock & Roll Hall of Fame (Cleveland)

Location: Downtown Cleveland

Annual Visitors: Over 500,000

Located on the scenic shores of Lake Erie, the Rock & Roll Hall of Fame is one of the most iconic music museums in the world. It’s a bucket-list destination for music lovers from across the U.S. and beyond.

How It Impacts Airbnb Demand:

- Attracts out-of-state and international travelers

- Major events, exhibits, and concert series throughout the year

- Ideal for rentals in Ohio City, Tremont, or downtown Cleveland

Tip: Properties with a retro or music-themed design can appeal to Rock Hall visitors and boost bookings.

2. Cedar Point Amusement Park (Sandusky)

Location: Sandusky, OH

Annual Visitors: Over 3 million

Known as “The Roller Coaster Capital of the World,” Cedar Point draws adrenaline junkies and families from all over the country every summer. It’s consistently ranked among the top amusement parks in the world.

Airbnb Demand Drivers:

- Huge seasonal influx (May to September)

- Perfect for family-sized rentals and group accommodations

- Properties within a 15-minute drive command premium nightly rates

Investing in Sandusky or surrounding towns like Port Clinton can yield massive returns during peak summer months.

3. Hocking Hills State Park (Logan)

Location: Southeastern Ohio

Annual Visitors: Estimated 2–3 million

Hocking Hills is Ohio’s premier outdoor adventure destination. With dramatic cliffs, waterfalls, caves, and miles of hiking trails, it's the go-to getaway for couples, families, and nature enthusiasts.

Airbnb Impact:

- High demand for cabins, A-frames, and glamping sites

- Strong bookings even in off-peak seasons (fall foliage, winter retreats)

- Luxury cabins with hot tubs or fire pits command higher ADRs

Cabins in Hocking Hills regularly outperform urban apartments in terms of nightly rate.

4. Cuyahoga Valley National Park (Near Akron & Cleveland)

Location: Between Cleveland and Akron

Annual Visitors: Over 2.2 million

One of only a few national parks in the Midwest, Cuyahoga Valley National Park offers a stunning combination of hiking, waterfalls, wildlife, and history. It's popular with weekend travelers from major metro areas.

Why This Matters for Investors:

- Year-round demand for eco-travel and wellness retreats

- Boosts Airbnb bookings in Akron, Peninsula, and Hudson

- Strong occupancy rates for small cottages and nature-themed stays

Adding hiking maps, yoga mats, or eco-friendly amenities to your listing can help your Airbnb stand out.

5. National Museum of the U.S. Air Force (Dayton)

Location: Wright-Patterson AFB, Dayton

Annual Visitors: Over 1 million

This is the largest military aviation museum in the world—and it’s completely free to visit. The National Museum of the U.S. Air Force attracts aviation enthusiasts, school groups, veterans, and families.

Airbnb Demand Boost:

- Steady flow of visitors year-round

- Frequent events, air shows, and commemorations

- Opportunities for themed rentals geared toward aviation buffs

Listings with aviation decor or close proximity to the base can create a niche experience for guests.

The Bottom Line:

Ohio’s tourism isn’t seasonal—it’s multi-dimensional. Whether your target guests are thrill-seekers, music fans, hikers, or history buffs, there’s a year-round demand driver to fill your calendar.

When selecting a city to invest in,

proximity to these top attractions can be a major advantage in both pricing and occupancy rates.

Final Thoughts: Should You Invest in an Airbnb in Ohio in 2025?

High ROI, Affordable Entry, and Year-Round Demand—Ohio Has It All

If you’re looking to start or expand your Airbnb portfolio in 2025, Ohio stands out as one of the best places to invest in the U.S. Whether you prefer the hustle of urban markets like Columbus, the charm of small towns like Vermilion, or the tranquility of nature escapes like Hocking Hills, Ohio offers something for every kind of investor.

Here’s why the Buckeye State is a smart move:

- Affordable real estate with high rental yield potential

- Steady occupancy rates, even outside major cities

- Diverse tourism drivers that support year-round bookings

- Investor-friendly regulations in most markets

- A mix of established and emerging Airbnb markets that allow you to choose your ideal strategy

And let’s not forget the most important part: you don’t need half a million dollars to get started here. Many top-performing cities in Ohio have median home prices under $200,000, making this a great opportunity for new investors, solo entrepreneurs, and seasoned STR veterans alike.

Need Help Managing Your Airbnb in Ohio?

Managing a short-term rental—especially remotely—can be overwhelming. That’s where we come in.

Home Team Luxury Rentals

Your trusted Ohio-based short-term rental management partner.

Whether you’re just starting out or scaling your Airbnb business across multiple cities, Home Team Luxury Rentals offers full-service Airbnb management in Ohio’s top-performing markets.

Here’s what we handle so you don’t have to:

- Professional listing optimization (photos, SEO, pricing)

- Cleaning coordination + maintenance

- 24/7 guest communication and support

- Smart pricing strategies to maximize ROI

- Monthly reporting + performance insights

"From city condos to rural retreats, we manage your property like it’s our own—because it is our home team."

Ready to invest in Ohio and want a team you can trust to manage it all?

Explore Airbnb Management in Ohio

Discover the Best Places to Buy an Airbnb