Discover the 20 Best Airbnb Markets in North Carolina (NC) for 2025

By: Aza Baylon | Jul 4, 2025

North Carolina continues to shine as a top destination for short-term rental investors in 2025. From high-yield coastal towns to stable urban hubs, the state offers a range of Airbnb markets ideal for both cash flow and long-term appreciation. Below, we break down the 10 best Airbnb markets in North Carolina, with key data like average daily rates (ADR), occupancy rates, and median home prices to guide your next investment.

1. Charlotte, NC

Why Charlotte Is a Top Short-Term Rental Market in North Carolina

- Average Daily Rate (ADR):$135

- Occupancy Rate: 60%

- Median Home Price:~$400,000

Airbnb Market Dynamics

Charlotte is one of the top Airbnb markets in North Carolina, offering both reliable returns and a growing base of short-term rental guests. The city’s short-term rental market continues to expand steadily, supported by a mix of urban tourists, sports fans, and business travelers. Airbnb properties in Charlotte perform especially well in areas like Uptown, South End, and Plaza Midwood—where guests look for walkable access to restaurants, stadiums, and nightlife.

Real Estate & Investor Outlook

Charlotte’s real estate market has proven appealing to both new and seasoned investors. With a median home price of around $400,000, the city strikes a balance between affordability and potential for appreciation. Airbnb operators in Charlotte often see gross annual revenue yields close to 7.8%, especially when properties are located near major attractions or transit hubs.

Whether you're looking to buy a turnkey Airbnb rental or renovate a property for higher returns, Charlotte is one of North Carolina’s most consistent performers. The city has a rising number of out-of-state buyers exploring Airbnb opportunities, especially as demand grows for well-furnished, centrally located listings.

Tourism & Short-Term Stay Demand

Charlotte is a major tourist draw in North Carolina. Visitors travel to the city for sports (NFL Panthers, NBA Hornets, NASCAR events), arts festivals, and its growing culinary and craft beer scene. The spring and fall seasons are especially active, with a spike in weekend getaways and family travel. With steady demand and a strong occupancy rate, many Airbnb hosts enjoy predictable booking activity throughout the year.

Business & Institutional Travel

Charlotte also has a robust base of business and institutional travelers. As the second-largest banking hub in the U.S., the city sees heavy booking traffic from financial professionals, consultants, and corporate teams. Additionally, proximity to Charlotte Douglas International Airport ensures midweek bookings for conferences and executive travel. This business-driven demand provides a reliable base that helps smooth out seasonal fluctuations in the vacation rental market.

North Carolina continues to shine as a top destination for short-term rental investors in 2025. From high-yield coastal towns to stable urban hubs, the state offers a range of Airbnb markets ideal for both cash flow and long-term appreciation. Below, we break down the 10 best Airbnb markets in North Carolina, with key data like average daily rates (ADR), occupancy rates, and median home prices to guide your next investment.

2. Raleigh, NC

Exploring Raleigh’s Strong Airbnb Market in North Carolina for 2025

- Average Daily Rate (ADR): $130

- Occupancy Rate: 62%

- Median Home Price:~$445,000

Airbnb Market Dynamics

Raleigh’s Airbnb market in NC is thriving, with a 62% occupancy rate and ADR of $130—making it one of the state’s most reliable short-term rental markets. High-performing listings sit near downtown, NC State, and Glenwood South, attracting a mix of tourists, remote workers, and convention-goers. With favorable regulations and a growing supply of nearly 1,700 STRs, Raleigh offers hosts consistent opportunity.

Real Estate & Investor Outlook

With a median home price around $445K and steady appreciation, Raleigh strikes a balance between affordability and growth potential. Investors see a reliable ~7%+ gross yield, citing strong demand from both local and out-of-state buyers.

Tourism & Short‑Term Stay Demand

Raleigh draws visitors year-round for tech conventions, university events, and cultural festivals. Demand peaks in spring and fall, with May as the strongest booking month.

Business & Institutional Travel

As the state capital and part of the Research Triangle, Raleigh hosts a steady influx of government personnel, academics, and healthcare affiliates. Midweek bookings provide a stable baseline even off-season.

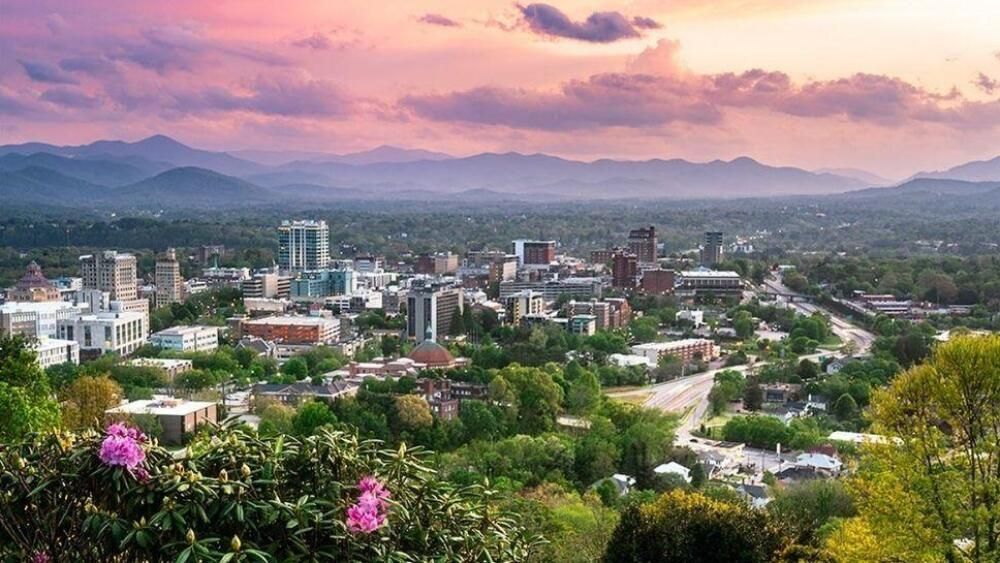

Asheville, NC: A High‑Demand Airbnb Market in Western North Carolina

- Average Daily Rate (ADR):$132

- Occupancy Rate: 60%

- Median Home Price:~$486,000

Airbnb Market Dynamics

Asheville continues to be one of NC’s top rental markets, with a median ADR of $132 and occupancy near 60%. Rentals in Downtown, West Asheville, and near the River Arts District perform best, catering to arts lovers, outdoor enthusiasts, and weekend travelers. Looser STR regulations support this growth.

Real Estate & Investor Outlook

Median home values in Asheville hover around $486K, with gross yields near 8%. Investors are drawn to renovation-friendly neighborhoods and strong tourist demand.

Tourism & Short‑Term Stay Demand

Situated near the Blue Ridge Parkway, Asheville attracts visitors for craft breweries, the Biltmore estate, and fall foliage festivities. Summer through fall brings the strongest bookings.

Business & Institutional Travel

Local draws include medical visitors, small businesses, and seasonal events. While smaller than urban markets, demand remains consistent year-round.

4. Carolina Beach, NC

Carolina Beach Offers One of the Best Airbnb Markets in Coastal North Carolina

- ADR:~$205

- Occupancy Rate:~61%

- Median Home Price:~$350,000

Airbnb Market Dynamics

Coastal rentals in Carolina Beach see a healthy 61% occupancy and ADR around $205. Homes near the boardwalk and beachfront condos are top earners during peak seasons. STR regulations remain favorable for hosts.

Real Estate & Investor Outlook

Median home values (~$350K) and strong seasonal demand yield returns close to 12% gross. These coastal properties attract both investors and vacation buyers alike.

Tourism & Short‑Term Stay Demand

Family getaways, events, and fishing tournaments drive peak bookings in summer, with shoulder seasons offering solid demand.

Business & Institutional Travel

Mainly limited to contractors, festival crews, and short-term event personnel—not a major business travel market.

5. Wilmington, NC

Wilmington’s Airbnb Scene Adds Strength to North Carolina’s Coastal Rental Markets

ADR:$170

Occupancy Rate:~58%

Median Home Price:~$300,000

Airbnb Market Dynamics

Coastal Wilmington enjoys an ADR around $170 and ~58% occupancy. Listings near the riverfront, historic district, and beachside suburbs see the highest returns. Regulatory requirements allow for flexible hosting strategies.

Real Estate & Investor Outlook

With a median price near $300K, investors can achieve ~7% yields, blending steady cash flow and long-term growth.

Tourism & Short‑Term Stay Demand

Tourists visit for beach vacations, weddings, river cruises, and film-related stays—stronger in summer with moderate off-season bookings.

Business & Institutional Travel

Continued demand stems from UNCW events, medical travelers, and film industry professionals.

6. Banner Elk, NC

Banner Elk: A Hidden Gem for STRs in Western North Carolina

ADR:~$225

Occupancy Rate:~63%

Median Home Price:~$495,000

Airbnb Market Dynamics

Located between Beech Mountain and Sugar Mountain ski resorts, Banner Elk thrives in the winter and fall. Cottages, cabins, and luxury condos see solid seasonal bookings.

Investor Outlook

Though home prices are mid-range, high nightly rates and weekend demand offer impressive yields (~10–12%) for vacation rental owners.

Travel Demand

Tourism is mainly leisure-focused—skiing, hiking, leaf-peeping, and wine tours dominate guest activity. Limited business travel, but consistent seasonal appeal.

7. Oak Island, NC

Oak Island’s Airbnb Growth Makes It a Coastal NC Market to Watch

ADR:~$272

Occupancy Rate:~57%

Median Home Price:~$644,000

Airbnb Market Dynamics

Oak Island attracts vacationers to upscale beach homes and condos, earning about $272/night with ~57% occupancy. High-end, full-home listings dominate the landscape.

Real Estate & Investor Outlook

Property values (~$644K) are high, but seasonal demand can produce strong gross yields around 12%.

Tourism & Short‑Term Stay Demand

Summer is peak season for families and fishing groups; spring and fall host tournament-driven bookings.

Business & Institutional Travel

Mostly event staff and project-related visitors—not a strong non-leisure market.

8. Kill Devil Hills, NC

Why Kill Devil Hills Is One of the Top Airbnb Markets in NC

ADR:~$265

Occupancy Rate:~55%

Median Home Price:~$580,000

Airbnb Market Dynamics

High-performing Airbnb listings are often located close to the beach, Wright Brothers Memorial, or along US-158. Coastal cottages and group-oriented beach houses are top choices.

Investor Outlook

With median home prices around $580K, the high ADR and peak season demand offer strong ROI, especially for turnkey properties or value-add renovations.

Tourism & Demand Trends

Summer is peak season, driven by family vacations. Advance bookings and seasonal consistency make it highly attractive for revenue-focused hosts.

Off-Season Activity

Off-season travelers include contractors, educators, and regional workers. While not a business hub, this keeps winter vacancy manageable.

9. North Topsail Beach, NC

North Topsail Beach Stands Out in North Carolina’s Short-Term Rental Market

ADR:~$290

Occupancy Rate:~56%

Median Home Price:~$615,000

STR Market Performance

Listings in North Topsail Beach include oceanfront homes, pet-friendly condos, and upgraded duplexes with beach access. Seasonal demand drives strong returns in summer months.

Investment Potential

With median home prices near $615K, strong summer earnings and high ADRs can deliver five-figure monthly returns during peak season.

Year-Round Demand Sources

Demand remains solid from traveling nurses, military families, and contractors—especially given proximity to Camp Lejeune.

10. Fayetteville, NC

Fayetteville Offers Affordable Entry Into the North Carolina Airbnb Market

ADR:~$115

Occupancy Rate:~59%

Median Home Price:~$220,000

Short-Term Rental Performance

Airbnb properties near Fort Liberty, downtown, and Cape Fear Medical Center perform best. Inventory includes affordable single-family homes and townhouses.

Investor-Friendly Entry Point

With a median price around $220K, Fayetteville offers low-cost entry and solid returns of 10%+ gross yield in many cases.

Who Books Here

The market is driven by military travel, regional business, sports events, and medical stays. Steady demand offsets the absence of major tourism draws.

11. Boone, NC

Boone Tops the List for Short-Term Rentals in North Carolina

ADR:~$250

Occupancy Rate:~65%

Median Home Price:~$450,000

Airbnb Market Dynamics

Boone is one of the most profitable STR markets in NC thanks to a high occupancy rate (~65%) and ADR near $250. Cabins, ski rentals, and downtown cottages all perform well year-round.

Real Estate & Investor Outlook

Median home prices (~$450K) remain accessible compared to other mountain towns. Investors can expect strong returns (~12–14% gross) especially with ski or luxury cabin properties.

Tourism & Booking Trends

Appalachian State University brings in steady traffic during the school year. Outdoor attractions like the Blue Ridge Parkway, hiking, and skiing support seasonal demand year-round.

Business & Institutional Travel

The market includes visiting faculty, university speakers, and healthcare travelers—modest but consistent business-related stays supplement leisure bookings.

12. Beech Mountain, NC

Beech Mountain Delivers High ADR and Strong Seasonal Returns

ADR:~$275

Occupancy Rate:~60%

Median Home Price:~$375,000

Airbnb Market Dynamics

Beech Mountain thrives in the winter ski season and fall foliage months. High nightly rates (~$275) and elevated occupancy support strong seasonal revenues, particularly for 2–4 bedroom homes.

Real Estate & Investor Outlook

With home prices averaging ~$375K, investors can enjoy robust gross yields (~13–15%) from short-term rentals, especially those close to ski lifts or hiking trails.

Seasonal Travel Demand

Visitors come primarily for skiing, snowboarding, and mountain biking. Demand spikes in winter, but shoulder seasons also attract strong weekend traffic.

Business & Off-Peak Travel

Limited business travel. Some off-season stays occur for retreats, work-from-home escapes, and local events.

13. Greenville, NC

Greenville’s Airbnb Potential Rises with Health‑Care and University Traffic

ADR:~$125 (estimated)

Occupancy Rate:~50–55% (estimated)

Median Home Price:~$270,000

Airbnb Market Dynamics

Greenville’s STR environment is growing, fueled by East Carolina University (ECU), Vidant Medical Center, and state agencies. Listings near campus and downtown show healthy occupancy.

Real Estate & Investor Outlook

Median home prices under $300K plus stable demand from academic and healthcare sectors offer investors >8% cash-on-cash yield. Some properties have been renovated for student or patient-family rentals.

Tourism & Short‑Term Stay Demand

East Carolina events, medical tourism, and annual festivals boost rental activity, especially during graduation season.

Business & Institutional Travel

Strong demand from business travelers, students, and visiting medical staff contributes to year-round stability.

14. Morganton, NC

Morganton Offers Affordable Entry and Outdoor-Driven Airbnb Demand

ADR:~$140 (estimated)

Occupancy Rate:~50% (estimated)

Median Home Price:~$240,000

Airbnb Market Dynamics

Morganton benefits from rising interest in outdoor escapes near Lake James and Linville Gorge. Listings with mountain views and large yards appeal to families and small groups. STR regulations are light.

Real Estate & Investor Outlook

With home prices around $240K, Morganton is attractive for investors seeking footholds with strong income potential, typically reviving around $30K–$40K annually.

Tourism & Short‑Term Stay Demand

Outdoor enthusiasts drive weekend bookings in spring through fall. The town receives spillover visits from Blowing Rock and Morganton festivals.

Business & Institutional Travel

Regional healthcare, logging, and government contractors bring occasional midweek demand.

15. New Bern, NC

New Bern and Nearby Coastal Towns Round Out North Carolina Airbnb Markets

ADR:~$150 (estimated)

Occupancy Rate:~55% (estimated)

Median Home Price:~$310,000

Airbnb Market Dynamics

Historic charm, waterfront attractions, and festivals (like Mumfest) make New Bern a seasonal STR hotspot. Listings include colonial homes, riverfront cottages, and modern condos near downtown.

Real Estate & Investor Outlook

Mid-priced homes (~$310K) with 10% gross yield potential are drawing investor interest from both local and coastal buyers.

Tourism & Short‑Term Stay Demand

Spring through fall sees stable tourism from nature lovers, heritage travelers, and event attendees.

Business & Institutional Travel

Stable bookings come from PPD Triad labs, regional healthcare, and small business professionals.

16. Sylva, NC

Sylva’s Small-Town Charm Drives Airbnb Growth in Western NC

ADR:~$165

Occupancy Rate:~52%

Median Home Price:~$325,000

Airbnb Market Dynamics

Sylva has gained traction among short-term rental hosts thanks to its picturesque downtown, nearby hiking trails, and proximity to the Great Smoky Mountains. STR listings—primarily cabins and mountain homes—perform well year-round, with seasonal boosts in spring and fall. Regulations remain lenient, making it a welcoming place for new Airbnb operators.

Real Estate & Investor Outlook

At a median home price of around $325,000, Sylva offers affordable entry into the mountain rental market. With solid ADR and growing demand, investors can expect gross yields in the 7–9% range, particularly for homes with scenic views or updated amenities.

Tourism & Short‑Term Stay Demand

Outdoor tourism fuels bookings here, with guests flocking to Blue Ridge Parkway, waterfalls, and nearby Cherokee cultural sites. October and April are peak seasons for STRs, driven by foliage and hiking weather.

Business & Institutional Travel

Western Carolina University and regional hospitals generate consistent business-related demand from visiting faculty, medical travelers, and academic events.

17. Carolina Beach, NC

Carolina Beach Remains a Top Coastal Airbnb Market in NC

ADR:~$275

Occupancy Rate:~63%

Median Home Price:~$660,000

Airbnb Market Dynamics

Carolina Beach remains one of the most popular Airbnb destinations on North Carolina’s coast. The market thrives on summer tourism, with top-performing properties often being beachfront condos or luxury homes with water views. Regulations are enforced but manageable, with permitting and zoning required in some areas.

Real Estate & Investor Outlook

Although property prices are higher—around $660,000—owners can see peak seasonal earnings that justify the investment. Some homes generate over $70,000 per year in gross STR income, especially those located within walking distance to the beach and boardwalk.

Tourism & Short‑Term Stay Demand

Tourism is the lifeblood of the local economy. Summer months (May through August) bring the highest occupancy and ADR, with events, fishing, and beach vacations filling calendars.

Business & Institutional Travel

While primarily leisure-based, the area sees occasional bookings from corporate retreats, work-from-anywhere travelers, and military families due to proximity to Wilmington.

18. Durham, NC

Durham’s Airbnb Market Mixes Steady Institutional Demand with Strong Seasonal Tourism

ADR:~$140–145

Occupancy Rate:~58–60%

Median Home Price:~$325,000–430,000

Airbnb Market Dynamics

Durham’s short-term rental (STR) market is thriving, supported by a consistent stream of bookings from business travelers, academics, and tourists. High-performing listings are typically located near Duke University, the medical center, and downtown arts and cultural districts. The mix includes guesthouses, bungalows, and modern condos. The city requires STR permits, but regulations are relatively host-friendly.

Real Estate & Investor Outlook

With median home prices ranging from ~$325K to $430K depending on the neighborhood, Durham remains attractive to investors. Central areas offer near 7% gross yields and steady cash flow, especially with 1–2 bedroom units. Renovation opportunities in historic neighborhoods continue to appeal to value-seeking buyers.

Tourism & Short‑Term Stay Demand

Durham benefits from strong spring and fall demand driven by university events, cultural festivals, local sports, and its emerging food scene. Proximity to the Research Triangle further enhances its appeal to leisure travelers.

Business & Institutional Travel

The market sees year-round demand from academic visitors, healthcare professionals, and families connected to Duke University and Duke Hospital. Tech companies and educational institutions help make Durham one of the more recession-resistant STR markets in North Carolina.

19. Atlantic Beach, NC

Atlantic Beach Offers Seasonal Strength for STR Investors in NC

ADR:~$250

Occupancy Rate:~57%

Median Home Price:~$590,000

Airbnb Market Dynamics

Atlantic Beach’s Airbnb market thrives during the summer, with strong occupancy and high ADR between Memorial Day and Labor Day. Listings near the beach, marina, or Fort Macon State Park tend to earn the most. The local government has STR guidelines but is largely open to vacation rentals.

Real Estate & Investor Outlook

Though home prices are higher—near $590,000—the earning potential makes this a worthwhile market. Many homes are rented seasonally at premium prices, and investors can expect high monthly income during the summer months.

Tourism & Short‑Term Stay Demand

Visitors come for fishing, boating, and beach vacations. The island sees the highest tourist volumes from late spring through early fall.

Business & Institutional Travel

Off-season bookings occur thanks to local government travel, military families from nearby bases, and traveling professionals, offering a moderate level of consistency outside summer.

20. High Point, NC

High Point is a Hidden Gem in NC’s Airbnb Rental Market

ADR:~$130

Occupancy Rate:~51%

Median Home Price:~$290,000

Airbnb Market Dynamics

High Point, known as the “Furniture Capital of the World,” has carved out a unique space in the short-term rental market. While not a traditional tourist destination, the city draws thousands of business travelers and designers for seasonal markets and trade shows. STR regulations are minimal, creating a smooth path for hosts.

Real Estate & Investor Outlook

With home prices around $290,000, High Point offers a low-barrier, high-yield opportunity for short-term rental investors. During major events, ADR can surge, allowing hosts to capitalize on short windows of intense demand.

Tourism & Short‑Term Stay Demand

The twice-yearly High Point Market furniture expo brings a massive influx of visitors, creating sharp seasonal spikes. Some hosts earn a quarter’s income in just a few weeks during these events.

Business & Institutional Travel

Aside from market events, High Point’s economy supports regular bookings from university staff, healthcare travelers, and consultants, helping balance out the event-driven seasonality.

21. Mars Hill, NC

Mars Hill is a High-Yield, Low-Regulation STR Market in the Blue Ridge

- ADR: ~$275

- Occupancy Rate: ~38%

- Median Home Price: ~$418,619

Airbnb Market Dynamics

Mars Hill house and cabin Airbnbs are gaining momentum thanks to minimal STR regulations and strong seasonal income potential. Despite a moderate occupancy rate of 38%, the market shows impressive revenue growth, with top-performing listings generating over $6,900 monthly. Proximity to the Appalachian Trail and year-round outdoor activities helps hosts attract adventure travelers and nature enthusiasts.

Real Estate & Investor Outlook

With a median home price of $418,619 and May 2025 listings reaching $575K (up 42% year-over-year), Mars Hill is emerging as a compelling market for investors seeking appreciation and income.

Vacation rental management in Mars Hill can enhance ROI, especially for properties near Lake Louise, Mars Hill University, or the ski slopes of Wolf Ridge.

Tourism & Short‑Term Stay Demand

Tourism demand peaks in July, October, and August, driven by hiking, fall foliage, and mountain getaways. Visitors come for the Appalachian Trail, Hot Springs, and outdoor escapes, often pairing their stays with trips to nearby Asheville. Mars Hill’s natural assets make it ideal for weekenders, couples, and families seeking peace and adventure.

Business & Institutional Travel

Mars Hill University provides a steady stream of year-round guests, including faculty, students’ families, and event attendees. While not a major business hub, the local calendar and academic draw help smooth out seasonality for well-located listings.

Ready to Invest in North Carolina’s Airbnb Markets?

Ready to Invest in North Carolina’s Airbnb Markets? Whether you're seeking luxury vacation homes or looking to break into profitable short-term rentals, Home Team Luxury Rentals offers exclusive access to North Carolina’s top-performing properties. At The STR Report, we deliver data-driven insights to help investors make informed decisions in the Airbnb space. At Rise Collective, we combine data, design, and demand to build high-yield STR portfolios. Contact us for personalized market insights or a custom investment analysis tailored to your goals.